FPA Statements

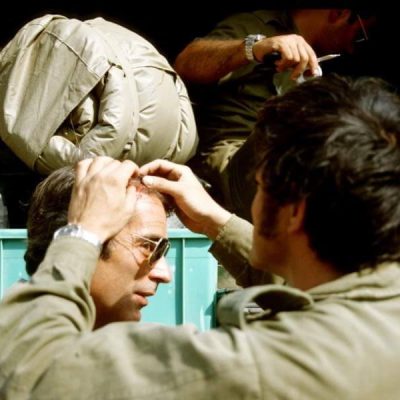

The Foreign Press Association is alarmed that six months into the Israel-Hamas war, Israel continues to bar international reporters from entering any part of the Gaza Strip independently.

About

Our primary mission focuses on protecting the interests of reporters working in Israel, the West Bank and/or Gaza Strip who often find themselves overwhelmed or even threatened by the authorities on both sides of the Israeli/Palestinian divide.

Income Tax

Article 75A of the Income Tax Ordinance provides special tax benefits to journalists who are registered with the Foreign Press Association (FPA) and also meet two other criteria . . .

become an FPA Member

We encourage all journalists working for international news organizations and based in Israel, the West Bank and/or Gaza Strip to become members of the FPA.

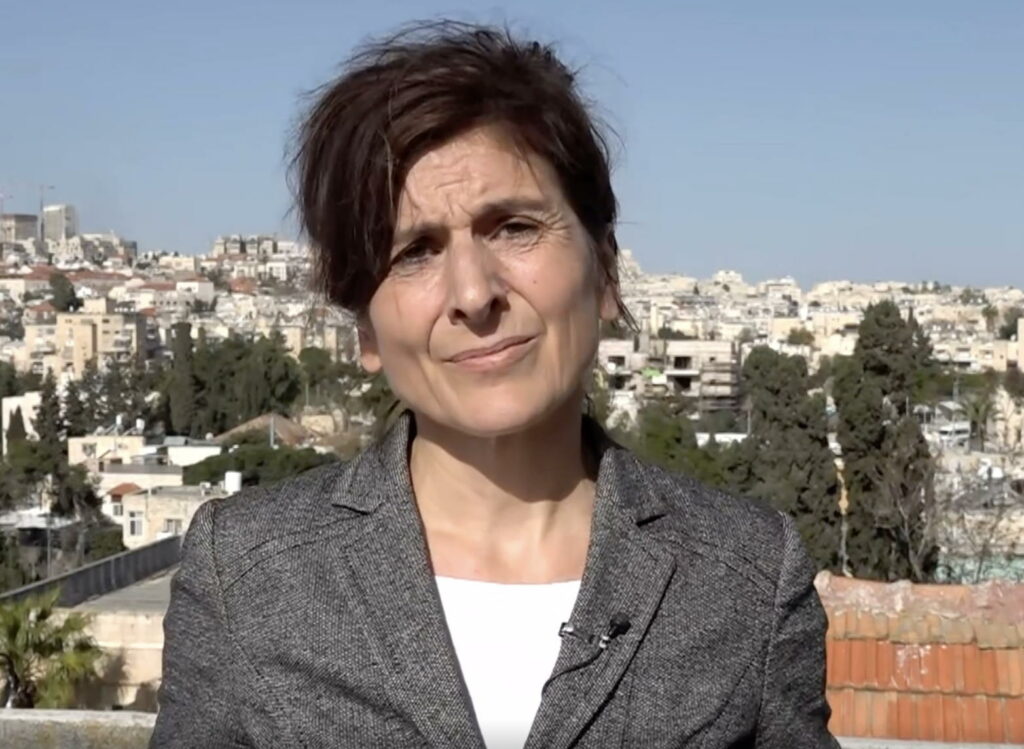

Chairperson Tania Kraemer

The current FPA Chairperson, Tania Kraemer, is the Jerusalem-based correspondent and video-journalist for Deutsche Welle for 10 years.

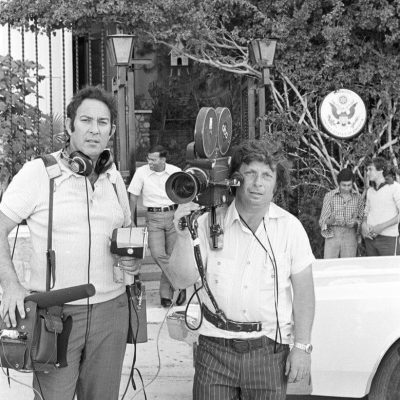

For over 65 years the FPA has represented journalists working for these and countless other news organizations from all over the globe, from Brooklyn to Beijing, from Stockholm to Sydney.